Introduction

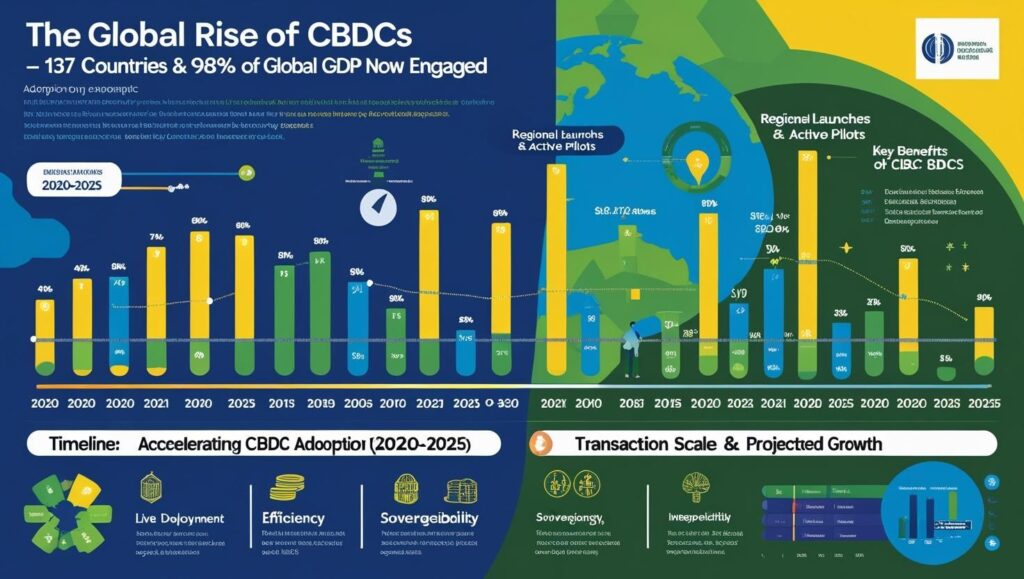

A Central Bank Digital Currency (CBDC) is a digital form of sovereign money, issued and regulated by a nation’s central bank. Unlike cryptocurrencies, CBDCs are legal tender, backed by the state, and designed to serve as a secure, efficient, and universally accessible means of payment. As of mid-2025, 137 countries and currency unions—representing 98% of global GDP—are exploring or piloting CBDCs, a dramatic leap from just 35 countries in 2020. This global momentum frames CBDCs as a peaceful, forward-looking innovation with the potential to deliver universal benefits: financial inclusion, payment efficiency, and monetary sovereignty.

Why CBDCs Matter Now

- Reduce Transaction Costs & Delays: CBDCs enable instant settlement, slashing transaction costs and eliminating delays that plague traditional payment systems. This efficiency is especially vital for cross-border payments, which are often slow and expensive.

- Empower Financial Inclusion: By offering risk-free digital money and supporting offline payments, CBDCs can reach the unbanked and underbanked, providing a gateway to the digital economy for millions who lack access to traditional banking.

- Strengthen Sovereignty & Competition: CBDCs offer a public alternative to private payment systems and foreign-dominated networks, reinforcing national monetary sovereignty and fostering healthy competition in the payments landscape.

CBDC Models & Design (Retail vs Wholesale)

| Model | Target Users | Key Features & Design Choices |

|---|---|---|

| Retail CBDC | General public, businesses | Digital cash for everyday use; prioritizes accessibility, privacy, offline capability, and user-friendly interfaces. |

| Wholesale CBDC | Financial institutions | Used for interbank settlements; focuses on high-value transactions, advanced security, and integration with existing financial infrastructure. |

Design Choices:

CBDC design must balance privacy, the role of intermediaries, offline functionality, and programmability. Retail CBDCs often emphasize privacy and accessibility, while wholesale CBDCs prioritize security and settlement efficiency.

Global Progress Report & Case Studies

Asia

- Japan: In pilot phase, with public debate centering on data privacy and user control.

- India: Piloting the e-Rupee, focusing on financial inclusion and robust offline payment capabilities. As of May 2024, e-Rupee in circulation reached 3.23 billion rupees, but this remains a small fraction of total cash in use.

Middle East & Africa

- UAE: Launched the “Digital Dirham” and completed a cross-border proof-of-concept with Bahrain.

- Nigeria: The e-Naira faces adoption challenges due to public trust and infrastructure limitations, highlighting the importance of digital literacy and reliable connectivity.

Europe & U.S.

- Europe: The digital euro is under design, with a strong emphasis on privacy and user choice.

- United States: The digital dollar remains restricted, with policymakers cautious amid geopolitical and privacy concerns. However, the U.S. is under increasing pressure to keep pace with global digital currency developments.

Key Benefits & Considerations

- Financial Inclusion: Central Bank Digital Currency can provide digital money to those without bank accounts, especially in rural or underserved areas, and help build digital identities.

- Efficiency & Telecom: Enhanced cross-border payments, real-time settlement, and reduced reliance on intermediaries can transform both domestic and international transactions.

- Privacy vs. Control: Striking the right balance between user privacy and regulatory oversight is crucial. Well-designed CBDCs can safeguard citizen data while ensuring compliance with anti-money laundering and counter-terrorism rules.

Challenges & Risks

- Public Trust: Concerns over surveillance, data privacy, and potential misuse of transaction data remain significant barriers to adoption.

- Bank Disintermediation: If consumers shift large deposits to CBDCs, traditional banks could face funding challenges, potentially impacting credit availability and financial stability.

- Technical & Infrastructure Hurdles: Low digital literacy, limited smartphone penetration, and patchy rural connectivity can impede CBDC adoption, especially in developing economies.

What’s Next in 2025?

- Pakistan: Launched a CBDC pilot, joining the growing list of countries actively testing digital currencies.

- Europe: The digital euro is expected to finalize key design decisions, with public consultations ongoing.

- United States: The stance on a digital dollar is evolving, influenced by global trends and domestic debates on privacy, innovation, and monetary policy.

Conclusion & Practical Advice

CBDCs are emerging as inclusive, efficient, and future-ready public money. Their success will depend on thoughtful design, robust privacy safeguards, and widespread financial education. As a reader, you can:

- Stay informed: Follow updates from your central bank and international organizations.

- Consider privacy: Understand how your country balances privacy and regulatory needs in its CBDC design.

- Track pilot results: Watch for pilot outcomes and public consultations to see how CBDCs might impact your daily life.

The journey toward CBDCs is just beginning, but their potential to reshape the global financial landscape is undeniable. Stay curious, stay engaged, and be ready to navigate the future of money.

Resources

https://www.elibrary.imf.org/view/journals/087/2024/004/article-A001-en.xml

https://www.atlanticcouncil.org/cbdctracker/

https://cbdctracker.org

https://www.imf.org/-/media/Files/Publications/FTN063/2024/English/FTNEA2024005.ashx

https://www.imf.org/-/media/Files/Publications/DP/2024/English/CBDCMECAEA.ashx

https://www.elibrary.imf.org/view/journals/063/2024/001/article-A001-en.xml

https://www.ecb.europa.eu/press/research-publications/resbull/2024/html/ecb.rb240918~86165cbefc.en.html

https://www.sec.gov/Archives/edgar/data/1625414/000141057825000824/bzun-20241231x20f.htm

https://www.sec.gov/Archives/edgar/data/1858724/000164117225006073/form20-f.htm

https://www.sec.gov/Archives/edgar/data/1793862/000141057825000705/dada-20241231x20f.htm

https://www.sec.gov/Archives/edgar/data/1896677/000095017025086278/gsol_s-1_amendment_1.htm

https://www.sec.gov/Archives/edgar/data/1815846/000141057825000858/mnso-20241231x20f.htm

https://www.sec.gov/Archives/edgar/data/1858724/000119312524232593/d439608d424b4.htm

https://www.sec.gov/Archives/edgar/data/2045872/000121390025054270/ea0245631-s1a1_bitwise.htm

https://www.ecb.europa.eu/pub/pdf/scpwps/ecb~cde4bd616e.wp3035en.pdf

https://www.imf.org/en/Topics/digital-payments-and-finance/central-bank-digital-currency/virtual-handbook

https://www.statista.com/topics/7782/central-bank-digital-currencies/

https://www.cato.org/blog/breakdown-different-cbdc-models

https://www.imf.org/-/media/Files/OAP/oap-home/2024/presentation-on-cbdc-tokyo-2024-final-tommaso.ashx

https://www.bis.org/cpmi/publ/d174.pdf

https://www.weforum.org/stories/2024/02/wholesale-retail-cbdcs-difference/

https://www.atlanticcouncil.org/blogs/econographics/which-countries-have-made-the-most-progress-in-cbdcs-so-far-in-2023/

https://www.federalreserve.gov/central-bank-digital-currency.htm

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4448351

https://www.bis.org/publ/bppdf/bispap123.pdf